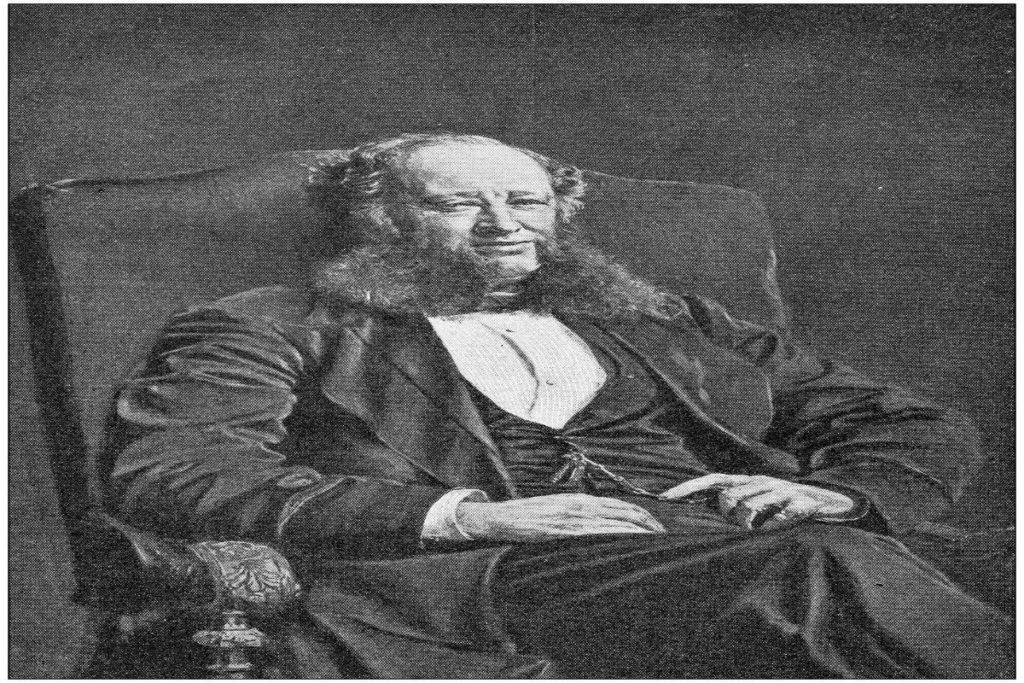

Cornelius Vanderbilt was among the wealthiest Americans of all time, making his fortune through railroads and commerce. To put his fortune into perspective, his net worth was an estimated $248.3 billion in today’s dollars after inflation.

Vanderbilt’s estate planning structure was straightforward. He bequeathed nearly 95% of his fortune to his son, William Henry. Vanderbilt’s will instructed his son not to waste the inheritance. Instead, he recommended his son invest the money so that it would increase. William Henry followed his father’s wishes and managed the family wealth beautifully. The Vanderbilt fortune had more than doubled by the time William Henry died. With this large of a fortune, surely it was able to last generations, right?

Well, one would think. However, despite having a large fortune and most likely a team of competent attorneys at his disposal, William Henry decides to make his own will. This was a significant blunder since William Henry disregarded his father’s instructions when it came to pass on the inheritance to his children. Instead, William Henry divided the Vanderbilt money (which, remember, was built by his father) among his children. There were no requirements to invest the inheritance, nor were there any restrictions on how the funds may be spent. As a result, the Vanderbilt heirs simply spent the majority of their inheritance on costly things and a luxury lifestyle.

Reading about these failures and sharing the lessons learned is not only a great way to learn, but it’s also perhaps the safest way to learn. Here’s what we can learn vicariously from the state of the Vanderbilt fortune:

Strategize on your Own Terms

Strategizing on your own terms means creating an estate plan that accounts for what you want your legacy to look like. It may appear to be a no-brainer, but the numbers on how many Americans have an estate plan paint a worrisome story. As many as 40% of Americans pass without a will. If you die without a will, state law governs who inherits your property. This may not be what you want in many circumstances. If you have an estate, you will need an estate planning attorney to ensure that everything is properly documented and accounted for.

Victory Begins with Preparation

Teach your heirs how to manage and control your assets, especially if you have a vision regarding what you want your legacy to look like. Discuss with them what your mission is, as well as what you want your wealth to accomplish. Don’t leave them guessing. Indeed, you might want to sit down and discuss the family’s goal statement to ensure that everyone is on the same page. Discussing your assets and the terms well before there is a wealth transfer significantly reduces family friction – long before someone dies.

Make Organization a Priority

Organize your financial paperwork: Keep all of your financial documents in one place and clearly identify them, so your heirs know what they are. You don’t want them to have to search for various portions of your estate. Keep all of this information in a secure location and notify your heirs of its whereabouts. It should go without saying, but we will: keep track of your estate planning documents too. Your wishes cannot be carried out if the documents memorializing them cannot be found at your death.

Contact Us to Protect Your Assets and Legacy

If you’re considering creating an estate plan to protect your legacy, a good place to start is by attending one of Promise Law’s free estate planning workshops. These workshops provide a great foundation of information that everyone needs to make sound planning decisions. Moreover, if you attend an estate planning workshop, you also get a complimentary one-on-one consultation.